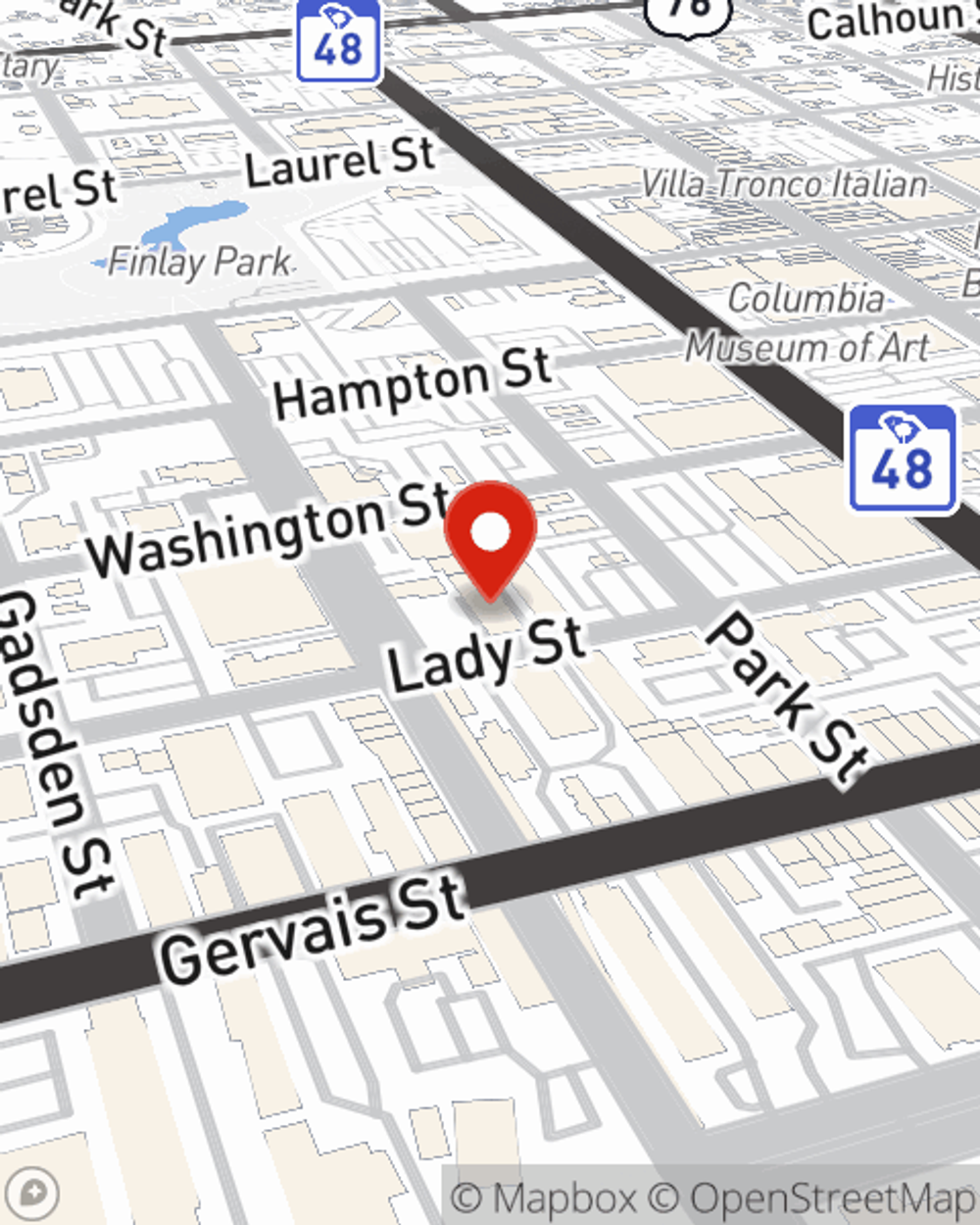

Life Insurance in and around Columbia

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Columbia

- Blythewood

- Camden

- Elgin

- Irmo

- Lexington

- Pontiac

- Eastover

- Chapin

- West Columbia

- Cayce

- Gaston

- Lugoff

- Forest Acres

- Ridgeway

- Five Points

- Shandon

- Dentsville

- Fort Jackson

- Springdale

- Oak Grove

- Ballentine

- Lake Murray

State Farm Offers Life Insurance Options, Too

It can be a big deal to provide for those closest to you, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your loved ones can pay off debts and/or maintain a current standard of living as they mourn your loss.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Why Columbia Chooses State Farm

You’ll get that and more with State Farm life insurance. State Farm has outstanding coverage options to keep those you love safe with a policy that’s modified to accommodate your specific needs. Thankfully you won’t have to figure that out by yourself. With strong values and outstanding customer service, State Farm Agent Barry Johnson walks you through every step to provide you with coverage that protects your loved ones and everything you’ve planned for them.

Simply reach out to State Farm agent Barry Johnson's office today to learn more about how a company that processes nearly forty thousand claims each day can help cover your loved ones.

Have More Questions About Life Insurance?

Call Barry at (803) 788-2884 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Barry Johnson

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.